Introduction

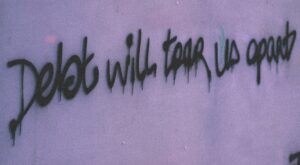

In today’s fast-paced world, it’s not uncommon for individuals to accumulate multiple debts across various sources such as credit cards, loans, and lines of credit. Managing multiple monthly payments, interest rates, and due dates can be overwhelming and lead to financial stress. Debt consolidation loans offer a potential solution by combining all your debts into a single loan, simplifying your financial obligations and providing a clear path to debt freedom. In this article, we will delve into the concept of debt consolidation loans, their benefits, considerations, and how they can help you regain control of your financial well-being.

Debt consolidation

Understanding Debt Consolidation

Debt consolidation is a financial strategy that involves merging multiple debts into a single loan, usually at a lower interest rate. This consolidation simplifies the repayment process by eliminating the need to manage multiple payments and creditors. Instead, you make a single monthly payment towards the consolidation loan. Debt consolidation loans can be obtained through banks, credit unions, online lenders, or specialized debt consolidation companies.

Benefits of Debt Consolidation Loans

Streamlined Repayment: By consolidating your debts, you can simplify your financial obligations by having only one monthly payment to manage, making it easier to budget and stay organized.

Lower Interest Rates: Debt consolidation loans often come with lower interest rates compared to credit cards or other high-interest loans. This can result in significant savings over time, allowing you to pay off your debt faster.

Debt-Free Date: With a debt consolidation loan, you can have a clear timeline for becoming debt-free. By making regular payments, you’ll see progress towards reducing your debt balance, giving you a sense of achievement and motivation.

Types of Debt Consolidation Loans

Secured Debt Consolidation Loans: These loans require collateral, such as your home or car, to secure the loan. Secured loans typically have lower interest rates and higher borrowing limits, but they pose the risk of losing your collateral if you default on payments.

Unsecured Debt Consolidation Loans: These loans do not require collateral but often have higher interest rates and lower borrowing limits. They are ideal for individuals who do not have valuable assets to offer as collateral.

Considerations Before Consolidating Debt

Assess Your Financial Situation: Before pursuing a debt consolidation loan, evaluate your overall financial health, including your income, expenses, and credit score. Understanding your financial standing will help you determine if consolidation is the right choice.

Research Lenders: Explore different lenders to find the best debt consolidation loan terms and interest rates. Compare offers from various sources and consider the reputation and customer reviews of the lenders you are considering.

Beware of Scams: Unfortunately, the debt consolidation industry attracts some unscrupulous companies. Be cautious of offers that sound too good to be true, such as “instant debt relief” or “guaranteed approvals.” Research and choose reputable and trustworthy lenders.

Steps to Obtain a Debt Consolidation Loan

Determine the Amount: Calculate the total amount of debt you wish to consolidate, including outstanding balances and interest rates.

Research and Compare Loan Offers: Request loan quotes from different lenders, comparing interest rates, fees, repayment terms, and eligibility criteria.

Gather Documentation: Prepare the necessary documentation, including proof of income, identification, and financial statements.

Apply for the Loan: Complete the application process with your chosen lender, providing accurate information and ensuring you understand the terms and conditions.

Repay Your Debts: Once approved, use the loan proceeds to pay off your existing debts, and then make timely payments on your consolidation loan.

Maintaining Financial Discipline

While debt consolidation loans can provide relief, it’s essential to develop healthy financial habits to avoid falling into debt again. Create a budget, track your expenses, and resist the temptation of unnecessary spending. Consider seeking professional advice from financial advisors or credit counseling services to help you develop a sustainable financial plan.

Conclusion

Debt consolidation loans can be a valuable tool for individuals looking to simplify their finances and regain control over their debt. By understanding the concept, benefits, and considerations associated with debt consolidation, you can make an informed decision regarding your financial well-being. Remember, it’s not just about consolidating debt but also adopting responsible financial habits to ensure long-term financial stability. Take charge of your financial future and pave the way to a debt-free life.

Frequently Asked Questions

What is a debt consolidation loan?

A debt consolidation loan is a financial product that combines multiple debts into a single loan. It allows individuals to simplify their debt management by having only one monthly payment to make, often at a lower interest rate than their existing debts.

How does a debt consolidation loan work?

When you obtain a debt consolidation loan, the funds are used to pay off your existing debts. This leaves you with a single loan to repay, usually with a fixed monthly payment. The goal is to streamline your debt repayment process, potentially lower your interest rate, and make it easier to manage your finances.

What types of debts can be consolidated with a debt consolidation loan?

Debt consolidation loans can typically be used to consolidate various unsecured debts, such as credit card balances, personal loans, medical bills, and lines of credit. However, it’s important to note that secured debts, such as mortgage loans or car loans, are not typically eligible for consolidation.

What are the benefits of a debt consolidation loan?

There are several benefits to obtaining a debt consolidation loan:

Simplified repayment: You have one monthly payment to manage instead of multiple payments to different creditors.

Potential interest savings: Debt consolidation loans often come with lower interest rates, which can save you money over time.

Clear debt-free timeline: With a consolidation loan, you have a structured repayment plan, allowing you to see progress towards becoming debt-free.

Are there any risks associated with debt consolidation loans?

While debt consolidation loans can be beneficial, it’s essential to consider potential risks:

Accumulating more debt: If you continue to use credit cards or accumulate new debts while repaying the consolidation loan, you may end up in a worse financial situation.

Fees and charges: Some lenders may charge fees for initiating a debt consolidation loan, so it’s important to understand the associated costs.

Collateral requirements: Secured debt consolidation loans may require collateral, such as your home or car. Failing to make payments could result in the loss of your assets.

Is a debt consolidation loan the right choice for everyone?

Debt consolidation loans may not be suitable for everyone. It’s important to assess your financial situation, evaluate the terms and conditions of the loan, and consider alternatives such as budgeting, negotiating with creditors, or seeking credit counseling. A debt consolidation loan is a personal financial decision that should align with your goals and circumstances.

How can I qualify for a debt consolidation loan?

Eligibility criteria vary among lenders, but common requirements include a good credit score, stable income, and a manageable debt-to-income ratio. Lenders will also consider factors such as employment history and overall financial stability. It’s advisable to research and compare loan offers from different lenders to find one that suits your needs.

Will getting a debt consolidation loan affect my credit score?

Initially, applying for a debt consolidation loan may result in a temporary dip in your credit score due to the hard inquiry on your credit report. However, if you make timely payments on your consolidation loan and manage your finances responsibly, it can have a positive long-term impact on your credit score by reducing your overall debt and improving your payment history.

Should I work with a debt consolidation company or use a traditional lender?

The choice between a debt consolidation company and a traditional lender depends on your specific needs and preferences. Traditional lenders, such as banks or credit unions, often offer lower interest rates and more structured repayment plans. Debt consolidation companies may provide specialized services but may come with higher fees. It’s important to research and compare options before making a decision.

Are there alternatives to debt consolidation loans?

Yes, there are alternatives to debt consolidation loans. These include:

Debt management plans: Offered by credit counseling agencies, they involve negotiating with creditors to lower interest rates and create a structured repayment plan.

Balance transfer credit cards: Some credit cards allow you to transfer balances from high-interest cards to a new card with a low or 0% introductory interest rate.

Personal budgeting and financial counseling: Working with a financial advisor or credit counselor can help you develop a budget, manage your expenses, and create a customized plan to pay off your debts.

Leave a Comment