Which loan is easy to borrow? In today’s world, financial emergencies and needs arise unexpectedly—whether it’s for medical expenses, education, starting a small business, or fixing a broken-down car. During such times, people often ask “which loan is easy to borrow?” Finding the right type of loan can make all the difference between quick relief and frustrating delays.

In this blog post, we’ll explore the easiest loans to borrow based on accessibility, documentation requirements, credit score demands, and approval time. We’ll also examine the pros and cons of each option, helping you make informed decisions that match your financial situation.

Which Loan is Easy to Borrow?

What Determines if a Loan is Easy to Borrow?

Before diving into the types of loans, it’s important to understand the factors that make a loan “easy to borrow.” These include:

Minimal Documentation: Fewer requirements often mean quicker approvals.

Fast Disbursement: Speed matters, especially in emergencies.

Low or No Credit Check: Some loans are designed for people with poor or no credit history.

Online Accessibility: The ability to apply online increases convenience.

Flexible Eligibility Criteria: Fewer restrictions on employment status or income.

Now, let’s explore various loan types to determine which loan is easy to borrow.

Also read from: consumerfinance.gov

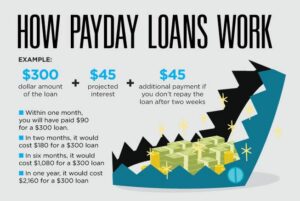

1. Payday Loans: Fast but Risky

Why it’s easy: Payday loans are often approved quickly, sometimes within minutes. They require little to no credit check, and the only requirements are proof of income and a bank account.

Pros:

Instant approval (sometimes in less than 30 minutes)

No collateral needed

No major credit check

Cons:

Extremely high interest rates (often exceeding 300% APR)

Short repayment period (usually 2–4 weeks)

Can lead to a debt cycle if not paid on time

Verdict: While it tops the list in terms of accessibility, it’s also the riskiest. Consider only if you’re confident you can repay it on time.

2. Online Personal Loans: Convenient and Moderate Requirements

Why it’s easy: Many fintech platforms and mobile apps now offer personal loans with easy applications, minimal paperwork, and quick disbursement—sometimes within 24 hours.

Pros:

Apply from anywhere via smartphone or computer

Competitive interest rates (compared to payday loans)

Moderate eligibility criteria

Cons:

May still require a fair credit score

Interest rates vary based on your credit profile

Verdict: A great option for salaried employees or self-employed individuals with stable income. If you’re searching for which loan is easy to borrow with moderate risks, this is a good choice.

which loan is easy to borrow?

3. Salary Advance Loans: Ideal for Salaried Workers

Why it’s easy: These loans are offered by some employers or third-party financial institutions to salaried workers. Repayment is often deducted directly from your next paycheck.

Pros:

Fast approval and disbursement

Automatic repayment through salary deduction

No collateral needed

Cons:

Limited to salaried employees

Usually small amounts (one month’s salary or less)

Verdict: One of the most hassle-free options for employees in organized sectors. If you’re employed and need fast cash, this could be the answer to which loan is easy to borrow.

Also read on: The best apps to borrow money in USA

4. Credit Card Cash Advance: Instantly Available

Why it’s easy: If you already own a credit card, accessing cash through a cash advance feature is quick and easy—often just a matter of visiting an ATM.

Pros:

Instant access to funds

No application or approval process needed

Convenient in emergencies

Cons:

High interest rate

Additional cash advance fees

No grace period—interest accrues immediately

Verdict: Best for short-term, small emergencies. Use cautiously due to high costs.

which loan is easy to borrow?

5. Microfinance Loans: Great for Low-Income Earners

Why it’s easy: Microfinance institutions often target low-income earners and small business owners. Their processes are simple, and collateral is rarely required.

Pros:

Tailored for small-scale borrowers

Flexible terms and repayment plans

Accept group guarantees instead of collateral

Cons:

Smaller loan amounts

May require group membership or peer guarantees

Verdict: A good option if you have limited access to formal banking. Among community-based solutions, this ranks high when asking which loan is easy to borrow.

6. Peer-to-Peer Lending (P2P): Direct and Digital

Why it’s easy: P2P platforms connect borrowers directly with individual lenders. The application process is online and straightforward.

Pros:

Quick online approval

Flexible credit requirements

Sometimes lower interest rates than banks

Cons:

Not regulated in some regions

May attract higher default charges if not repaid

Verdict: Innovative and relatively easy, especially for those with fair credit. Worth exploring if available in your country.

7. Collateral-Free Government Loans: A Social Lifeline

Why it’s easy: In some countries, government-backed loans for SMEs, students, or unemployed youth are designed to support vulnerable populations without traditional barriers.

Pros:

No collateral needed

Low interest or interest-free

Encourages entrepreneurship and education

Cons:

May involve waiting periods or bureaucratic delays

Limited slots and eligibility

Verdict: Though not always fast, these loans are relatively easy to qualify for and offer favorable terms. If you’re eligible, these can be a long-term financial booster.

8. Mobile Money Loans: Digital and Instant

With mobile banking and fintech apps (e.g., Branch, Carbon, FairMoney), accessing loans is now as simple as a few taps on your phone.

Pros:

Instant loan offers after app registration

No paperwork

Accessible 24/7

Cons:

Initial loan limits may be low

High penalties for late repayment

Verdict: Among the easiest loans to borrow for smartphone users. Perfect for students, freelancers, or micro-entrepreneurs needing quick cash.

What About Bank Loans?

Traditional bank loans are reliable but not the easiest to borrow due to:

Lengthy paperwork

Strict credit requirements

Long processing times

If your question is “which loan is easy to borrow?”, conventional bank loans are generally not the top pick unless you already have a strong banking relationship and credit history.

Conclusion: Which Loan is Easy to Borrow?

So, which loan is easy to borrow depends on your current situation:

| Situation | Best Loan Option |

|---|---|

| Employed & salaried | Salary advance, online personal loan |

| Low-income earner | Microfinance loan |

| Student or youth | Government grant or education loan |

| No credit history | Mobile money loan or payday loan |

| Urgent need | Credit card cash advance |

Final Tip: While it’s tempting to go for the quickest loan, always consider total repayment amount, interest rate, and penalties for late payment. Easy loans often come at a cost. Choose wisely and borrow only what you need.

Frequently Asked Questions (FAQs)

1. Which loan is easy to borrow without a job?

Mobile money loans, microfinance loans, or peer-guaranteed loans can sometimes be accessed by unemployed individuals if other criteria like transaction history or group membership are met.

2. Which loan is easy to borrow online?

Fintech-based personal loans, P2P loans, and mobile app loans (e.g., Branch, FairMoney, PalmCredit) are the easiest online options.

3. Which loan is easy to borrow with bad credit?

Payday loans and some online lenders offer loans with minimal credit checks, though interest rates may be higher.

4. Which loan is easy to borrow instantly?

Credit card cash advances and mobile money loans are typically the fastest.

Leave a Comment