Introduction

Is Palmpay only in Nigeria? Within a short time, PalmPay has established itself as one of the most popular mobile payment applications in Africa. Though designed to facilitate digital transactions, it has millions of users in various countries, providing them with swift, safe, and gratifying financial solutions. In this hand, we will examine and respond to queries about how it works, its owners, and what advantages it offers the users.

Read more on: How can I create an Internet Banking?

What is PalmPay?

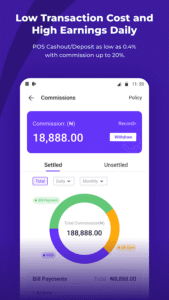

PalmPay is a fintech company that provides digital banking services, including:

Money transfers (to banks and other PalmPay users)

Airtime & data purchases

Bill payments (electricity, cable TV, etc.)

Cashback rewards & discounts

Savings & loan services

Launched in 2019, PalmPay quickly gained popularity in Nigeria due to its user-friendly interface and incentives like cashback rewards.

Is PalmPay Only Available in Nigeria?

As of 2024, PalmPay primarily operates in Nigeria, but it has expanded to a few other African countries.

1. PalmPay in Nigeria

Nigeria is PalmPay’s largest market, with millions of users. It works with local banks and integrates with Nigerian payment systems like NIBSS and Interswitch.

2. PalmPay in Ghana

PalmPay launched in Ghana in 2021, offering similar services as in Nigeria. Users in Ghana can:

Send and receive money

Pay bills

Buy airtime & data

Enjoy cashback rewards

3. PalmPay in Other African Countries

PalmPay has hinted at expanding to more African countries, including:

Kenya

Egypt

South Africa

However, as of now, PalmPay is officially available only in Nigeria and Ghana.

Is PalmPay only in Nigeria?

Why Hasn’t PalmPay Expanded Globally Yet?

Several factors influence PalmPay’s expansion:

Regulatory Approvals – Each country has strict financial regulations.

Market Competition – Countries like Kenya already have strong mobile money services (e.g., M-Pesa).

Infrastructure Requirements – PalmPay needs partnerships with local banks and telecom providers

Can I Use PalmPay Outside Nigeria & Ghana?

Currently, PalmPay does not support international transactions outside Nigeria and Ghana. However, you can still use it if:

You’re a Nigerian/Ghanaian traveling abroad – You can access your PalmPay app, but transactions may be limited.

You need to receive money from Nigeria/Ghana – If someone sends you money via PalmPay, you must withdraw it in Nigeria or Ghana.

Alternative Payment Apps for International Use

If you need a mobile payment app that works globally, consider:

PayPal – Available in most countries.

Wise (formerly TransferWise) – Supports multi-currency transactions.

Skrill – Popular for international money transfers.

Email: [email protected]

In-app live chat

Phone: 01-888-5555 (Nigeria)

Payoneer – Used by freelancers and businesses worldwide.

Will PalmPay Expand to the US, UK, or Europe?

There’s no official announcement yet, but PalmPay may consider expanding beyond Africa in the future. For now, it focuses on strengthening its presence in Nigeria and Ghana before entering new markets.

Frequently Asked Questions (FAQs)

1. Can I use PalmPay in the UK or USA?

No, is currently only available in Nigeria and Ghana.

2. Can I receive money from PalmPay if I’m outside Nigeria?

No, you must have a Nigerian or Ghanaian bank account to withdraw PalmPay funds.

3. Does PalmPay work in Kenya or South Africa?

Not yet, but PalmPay may expand there in the future.

4. What’s the best alternative to PalmPay for international transactions?

Use PayPal, Wise, or Payoneer for global transfers.

5. How do I contact PalmPay customer support?

Conclusion

PalmPay is currently only available in Nigeria and Ghana, with potential expansion to other African countries. While it doesn’t support international transactions yet, it remains a top choice for seamless mobile payments within Nigeria and Ghana.

If you need a global payment solution, consider alternatives like PayPal or Wise. For now, PalmPay continues to grow in Africa, and future expansions could bring it to more regions.

Leave a Comment