Introduction

When you need quick financial assistance, digital lending platforms like Okash provide a convenient solution. However, if you’re a first-time borrower, you might wonder, “How much can I borrow from Okash for the first time?” Clearly, understanding your borrowing limit is crucial because it helps you manage your finances effectively and avoid over-borrowing. Moreover, knowing this upfront allows you to plan your repayments better and build a good credit history

In this post, we’ll explore:

Okash’s loan limits for first-time borrowers

Factors that determine how much you can borrow

Tips to increase your loan limit

How to apply for an Okash loan

Repayment terms and interest rates

By the end of this guide, you’ll have a clear understanding of what to expect when borrowing from Okash for the first time.

How Much Can I Borrow from Okash For The First Time?

Also read on :Is Okash owned by Opay

What is Okash?

Okash is a digital lending platform operated by Opera, offering instant loans to individuals in need of short-term financial solutions. The app provides quick loans with minimal documentation, making it a popular choice for emergency funding.

Key Features of Okash:

Fast Disbursement – Loans are approved and disbursed within minutes.

No Collateral Required – Borrow without providing assets as security.

Flexible Repayment – Choose repayment terms that suit your budget.

Credit Scoring – Uses AI to assess creditworthiness.

Now, let’s dive into how much you can borrow as a first-time user.

How Much Can You Borrow from Okash as a First-Time Borrower?

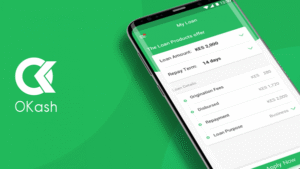

For first-time borrowers, Okash typically offers a minimum of ₦3,000 and a maximum of ₦50,000. However, your exact loan limit depends on several factors, including:

1. Credit Assessment

Okash uses an AI-powered credit scoring system to evaluate your loan eligibility. Factors considered include:

Your credit history (if available)

Your repayment behavior on other platforms (if linked)

Your device and transaction patterns

Since first-time borrowers have no prior repayment history with Okash, the initial loan amount may be conservative.

2. Income Level

While Okash doesn’t always require proof of income, your perceived ability to repay influences your loan limit. Users with verifiable income sources (e.g., bank transactions) may qualify for higher amounts.

3. Device and App Usage

Okash may analyze your smartphone data (with permission) to assess reliability. Active users with consistent financial behavior may get higher loan offers.

4. Repayment History (If Any)

If you’ve borrowed from other lending apps linked to Okash’s system, a good repayment record could increase your first-time limit.

Typical First-Time Loan Range:

| User Profile | Possible Loan Range |

|---|---|

| New user with no credit history | ₦3,000 – ₦20,000 |

| New user with linked financial data | ₦20,000 – ₦50,000 |

How to Increase Your Okash Loan Limit After First Borrowing

Since first-time borrowers usually get smaller amounts, you can increase your limit by:

1. Repaying On Time

Timely repayments build trust, leading to higher subsequent loan offers.

2. Borrowing Frequently (Responsibly)

Regular borrowing (without defaults) signals reliability.

3. Updating Your Financial Information

Linking bank accounts or providing additional income details can improve your limit.

4. Maintaining a Good Credit Score

Avoid defaults on other loans, as some lending apps share credit data.

How Much Can I Borrow from Okash For The First Time?

How to Apply for an Okash Loan as a First-Time Borrower

Step-by-Step Application Process:

Download the Okash App (Available on Google Play Store).

Register with your phone number and basic details.

Complete Your Profile (Provide necessary KYC details).

Select Loan Amount (The app will display your eligible limit).

Submit & Wait for Approval (Approval is instant for most users).

Receive Funds (Disbursed directly to your bank account).

Required Documents:

Valid ID (BVN, NIN, or Driver’s License)

Bank account details

Proof of income (sometimes optional)

Okash Loan Interest Rates and Repayment Terms

Before borrowing, understand the costs involved:

Interest Rates:

Okash charges daily interest rates ranging from 0.1% to 1%, translating to an annual percentage rate (APR) of 36% – 360%.

Example Calculation:

If you borrow ₦10,000 at 1% daily interest for 14 days:

Interest = ₦10,000 × 1% × 14 = ₦1,400

Total Repayment = ₦11,400

Repayment Tenure:

Loan durations range from 91 days to 365 days, but first-time borrowers may get shorter terms (e.g., 14–30 days).

Pros and Cons of Borrowing from Okash

Pros:

✔ Quick access to funds (within minutes)

✔ No collateral required

✔ Flexible repayment options

Cons:

✖ High-interest rates for short-term loans

✖ Limited first-time borrowing amounts

✖ Risk of aggressive debt recovery practices

Alternatives to Okash for First-Time Borrowers

If Okash’s limit doesn’t meet your needs, consider:

Branch (Offers up to ₦200,000 for new users)

FairMoney (First loans up to ₦150,000)

Carbon (Paylater) (Up to ₦500,000 for eligible users)

Frequently Asked Questions (FAQs)

1. Can I get ₦100,000 as a first-time borrower on Okash?

No, first-time borrowers typically receive between ₦3,000 – ₦50,000. Higher amounts require a repayment history.

2. What happens if I default on repayment?

Late payments attract penalties, and your credit score may be affected, reducing future loan eligibility.

3. How long does it take to receive an Okash loan?

Approval and disbursement happen within 5–10 minutes if all details are correct.

4. Can I extend my repayment date?

Some lenders allow extensions (with extra fees), but Okash’s policy varies. Check the app for options.

You can also read: Does Kuda Give a Loan

Final Thoughts

As a first-time borrower on Okash, you can typically access between ₦3,000 – ₦50,000, depending on your credit profile. While the initial limit may be low, timely repayments can help you unlock higher amounts in the future.

Before borrowing, assess your repayment ability to avoid debt traps. If Okash’s limit is insufficient, explore other digital lenders with higher first-time loan offers.

Need urgent cash? Download Okash today and check your eligible loan amount!

Leave a Comment